The incidence and cost of obesity or other metabolic syndrome conditions have grown at a startling rate over the last fifty years. These now impact people around the world, including emerging markets, and of all ages, including children.

The cost to society is reaching an unbearable level – estimates suggest a full 1% to 2% of world GDP in health costs due to bad diets. The cost is both large, and at the moment, largely hidden.

The game-changer is the discovery that sugar might be the main culprit. Global figures show a statistical correlation between increased intake of sugars and obesity levels. The scientific community has begun to focus on the causes of obesity, and has established an indirect link with the sugar content in modern diets.

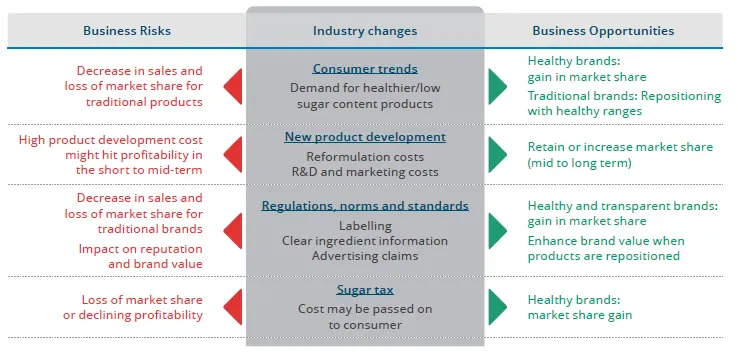

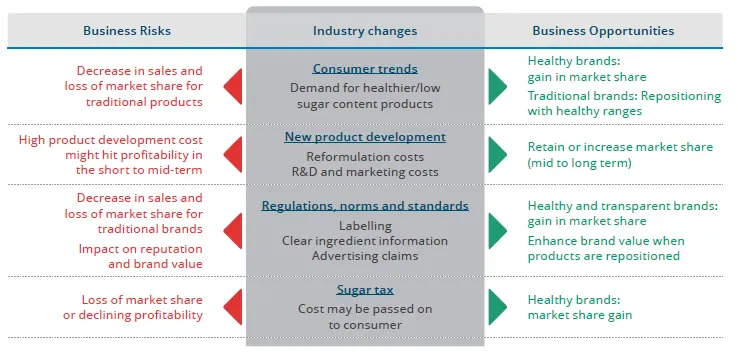

At Candriam, it is our strongly-held belief that companies which embrace sustainability-related opportunities and challenges in concert with their financial priorities are the most likely to generate shareholder value. We summarize some of these sugar-related business risks and strategic opportunities in the chart below.

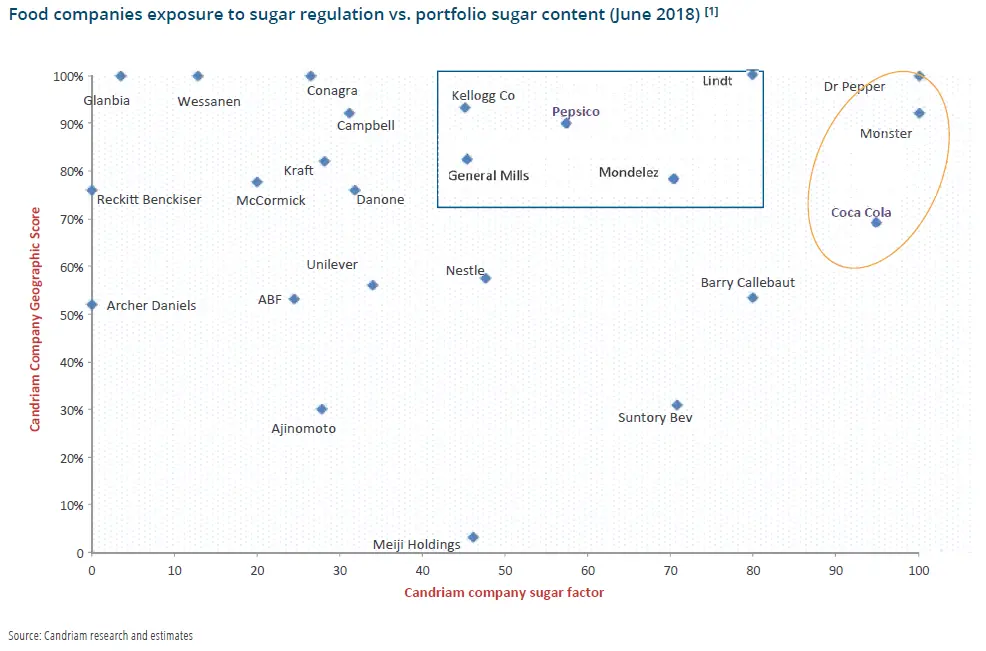

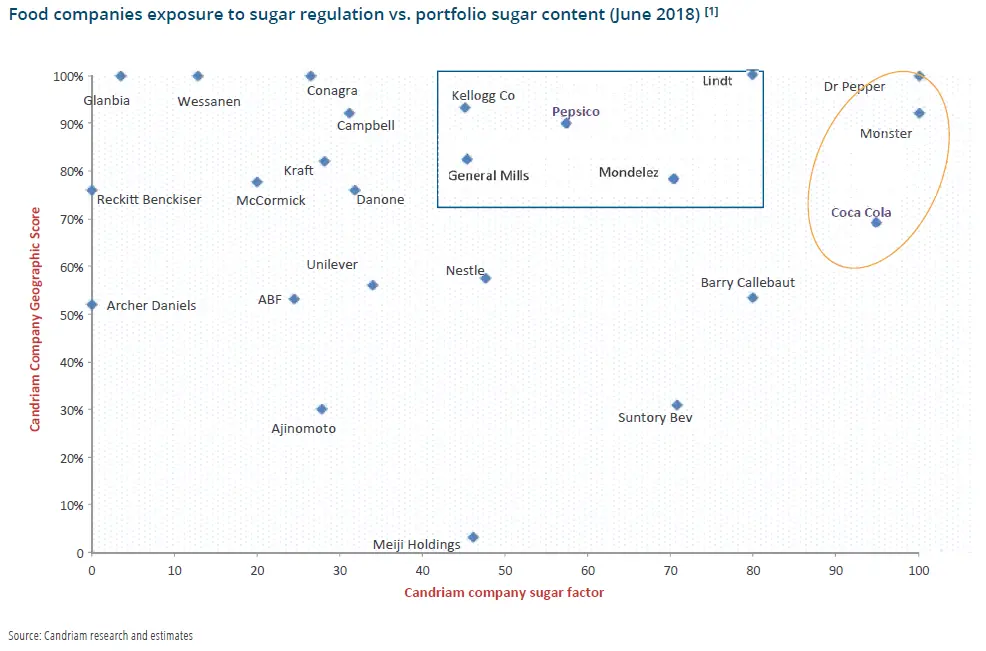

That’s why we have been and continue to engage with our investee companies in Food & Beverage to measure their efforts in regards to sugar risks, and to research company business portfolios and strategies to identify long-term winners. Many have elaborated clear strategies to address sugar risks; some are even taking up improved nutrition as a business opportunity. However, we have found that the companies with the worst positions on our 'sugar map' are also the ones least willing to engage or be transparent on the risks.

Generally, we find that the food & beverage industry is slowly evolving towards better nutrition practices. Through engaging with our investee companies, we have discovered a number of strategies are being implemented – from transformation of product portfolios to product recipe transformation – and a strong focus on sugar reduction. We believe this is a necessary direction for companies in the current consumer and regulatory environment to remain successful market players.

This is an ongoing issue. Our active engagement with companies continues, and we will update our study to continue to inform investors about hidden sugar and other health-related issues.

Download our study