Today’s corporate markets are in a flux. It is a time of opportunity, as well as heightened risk.

Spurred by the powerful forces unleashed by the COVID-19 pandemic, companies are reshaping the way they operate, not only to survive but to adapt to the new world.

At the same time, the environment of extremely low yields and high correlation between rates and credit spreads is providing an extra challenge for corporate bond investors. In this environment, investors require a truly flexible approach that can generate returns from opportunities regardless of market direction.

With this in mind, we launched the Candriam Bonds Credit Alpha Fund, which seeks to offer investors to capitalise in powerful market trends and help meet their requirements for attractive returns and diversification.

A true long/short approach to opportunities

Benchmarked against the return available from holding cash on deposit (EONIA Capitalized), Candriam Bonds Credit Alpha will use long and short positions in investment opportunities with the aim to deliver positive returns uncorrelated with credit markets.

Our investment strategy is built around two complementary performance engines, refined with a tactical overlay:

- Fundamental Long Short – to capitalise on the market dispersion resulting from disruptive trends and market themes, such as climate change, digitalization, and merger and acquisition.

- Quantitative Long Short – to capitalise on market-neutral opportunities within capital structures, driven by large flows from passive investments and monetary policies.

- Tactical Overlay – to help us manage credit exposure, mitigating volatility and correlation with credit markets.

What does our fund offers investors?

- Active and flexible management based on strong convictions

- Disciplined risk management

- Proven ability to identify opportunities, generate profits and manage risk

- Real alternative to traditional investment

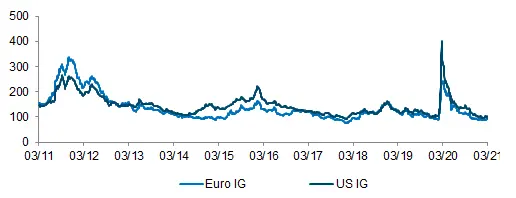

Ultra low credit spreads for investment grade bonds…..

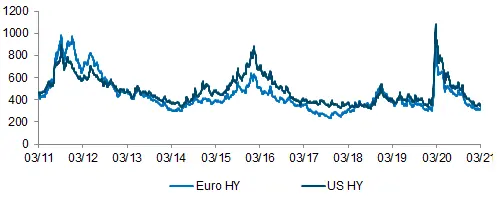

…and for high yield bonds

Source: Bloomberg, from 31.03.2011 to 31.03.2021

Main risks

For a full understanding of the fund’s risk profile, we advise investors to carefully read the prospectus and the description of the fund’s underlying risks, including the following risks associated with:

- Risk of loss of capital

- Interest rate risk

- Credit risk

- Financial derivatives risk

- Arbitrage risk

Investments may lose value due notably to the fund’s exposure to the main risks referred to in the fund prospectus and key investor information document.

The fund’s net book value will be published on the Candriam website.